E-File IRS Form 941 Online 2023

File Form 941 in minutes and get an instant approval

from the IRS.

For Just $5.99

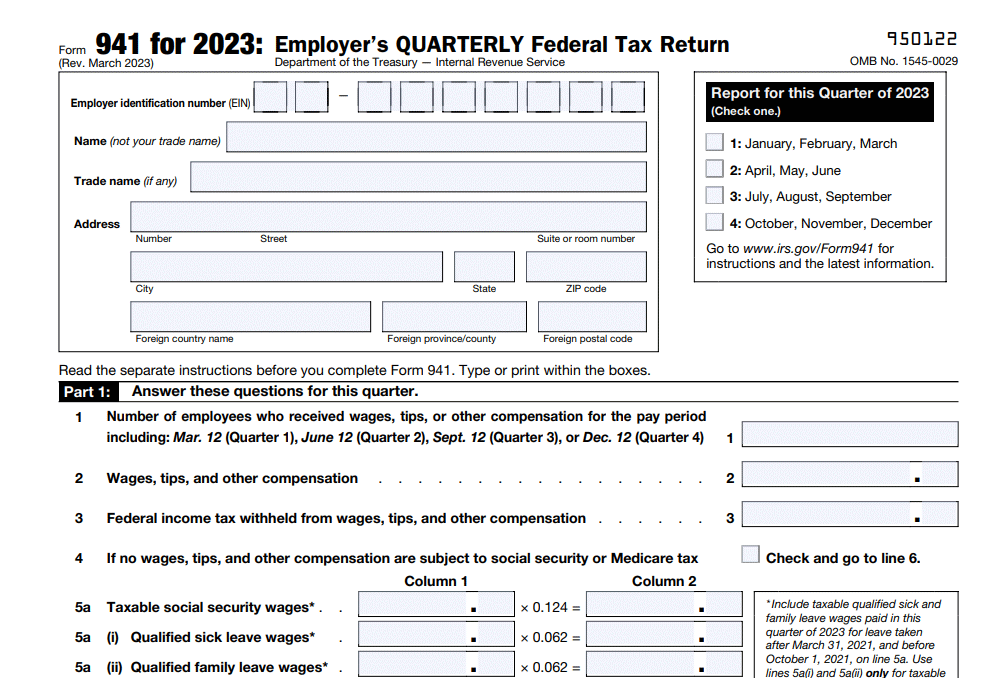

Form 941, also known as the Employer’s Quarterly Federal Tax Return, is a tax form that employers file quarterly to report income taxes, Social Security taxes, and Medicare taxes they withheld from employee paychecks. Form 941 also reports employer Social Security and Medicare taxes.

Form 941 must be filed quarterly. The deadline for filing Form 941 is the last day of the month following each quarter. Here are the calendar deadlines for filing Form 941

Jan, Feb, and Mar

May 01, 2023

Apr, May, and Jun

July 31, 2023

Jul, Aug, and Sep

October 31, 2023

Oct, Nov, and Dec

January 31, 2024

Using an IRS-authorized e-filing service such as 123PayStubs can help ensure that your Form 941 return is filed quickly, easily, and accurately. With 123PayStubs, you can file Form 941 securely and receive your filing status instantly

123PayStubs has many compelling features that will ensure your filing process is simple and easy. Some of these features include our accurate calculations, built-in error check, and dedicated support team.

A record of your Forms will be stored securely within your 123PayStubs account. You can access these forms easily by logging into your account from our website or mobile app.

With 123PayStubs, you can e-file Form 941 in just 3 simple steps. The process is simple, easy, and accurate

Having your forms stored securely within your 123PayStubs account will ensure you never lose an important document and you can access them whenever necessary.

If you miss filing your Form 941 before the deadline, you may incur a penalty of 5% of the total tax amount due. Following, you'll be penalized an additional 5% each month you don’t file for up to 5 months.

If you pay the full amount of taxes owed, the IRS will charge you a 0.5% tax of the unpaid tax amount.

Filing Form 941 online electronically is the suggested method. Using an IRS authorized e-filing service to file Form 941 ensures the process is simple and that your return is filed accurately and quickly. Follow these simple steps below to e-file Form 941 with 123PayStubs.

Using an IRS-authorized e-filing provider, such as 123Paystubs, you can ensure that your Form 941 return is filed quickly, easily, and accurately. 123paystubs helps to simplify the e-filing process while still providing the most compelling features. When you e-file Form 941 online with 123Paystubs, you can take advantage of the built-in error check, accurate calculations, and the easy-to-use interface. You will also receive your filing status instantly and be able to download or print your form when it is completed.

File Schedule B (Form 941) if you are a semiweekly schedule depositor. You are a semiweekly depositor if you:

| If you’re in... | Without a payment... | With a payment... |

|---|---|---|

| Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 | Internal Revenue Service P.O. Box 806532 Cincinnati, OH 45280-6532 |

| Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 | Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

| No legal residence or principal place of business in any state | Internal Revenue Service P.O. Box 409101 Ogden, UT 84409 | Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

| Special filing address for exempt organizations; federal, state, and local governmental entities; and Indian tribal governmental entities, regardless of location | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 | Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |